Securing the lowest mortgage rate in today’s market isn’t as straightforward as just picking a number off the shelf. As markets change, economies shift, and are also played by many other factors, what you do know is that getting that lower interest rate on your mortgage can change the game in terms of how it all plays out for the duration of your loan. This guide is to tell you the best interest mortgage trends, tips, and tricks which will put you in the best chance of getting the lowest mortgage rate possible.

Also, we will get right into what these industry secrets are, which will have you walking into that mortgage process with full confidence and leave with the best deal at hand.

1. Understand the Market—Timing Is Everything

When it comes to securing the best mortgage rate, timing is everything. Interest rate levels are determined by the economy; at the same time, when economic uncertainty rises, we see rates go down. At that point, investors tend to put their money in safe places like bonds, which in turn causes mortgage rates to fall.

How to Leverage Market Timing:

- Watch Economic Indicators: Pay attention to economic reports and market trends. When we see stock markets drop greatly or there is political and global instability, that is a good indicator that interest rates will go down as investors turn to safer options.

- Lock in at the Low: As soon as you see rates drop or have hit rock bottom, that is the time to lock in. Waiting it out may cause you to miss a better rate.

The key is to stay informed and act when the market reports an opportunity. You can save a lot of money by playing the interest rate fluctuations.

2. Boost Your Credit Score

Your credit score plays one of the most important roles in determining the interest rate on a mortgage you’ll receive. Lenders use your credit score to determine your risk as a borrower. The higher the score the better your terms. We see that generally a high credit score is a sure sign of a responsible borrower which at the same time is very much that you will pay back the loan in full and on time.

How to Improve Your Credit Score:

- Pay Your Bills Promptly: Late and missed payments are a big no-no for lenders. Your payment history is the primary thing that determines your credit score, so you must stay current with your payments.

- Pay Down Your Debts: Put your focus on reducing high interest debt like credit card balances to improve your debt to income ratio. Lenders prefer borrowers which have a manage able amount of debt in relation to their income.

- Do Not Open New Credit Accounts: Before you apply for a mortgage, do not open new lines of credit. Each new account opened leaves a mark on your credit score and also may signal to the lender that you are taking on more risk.

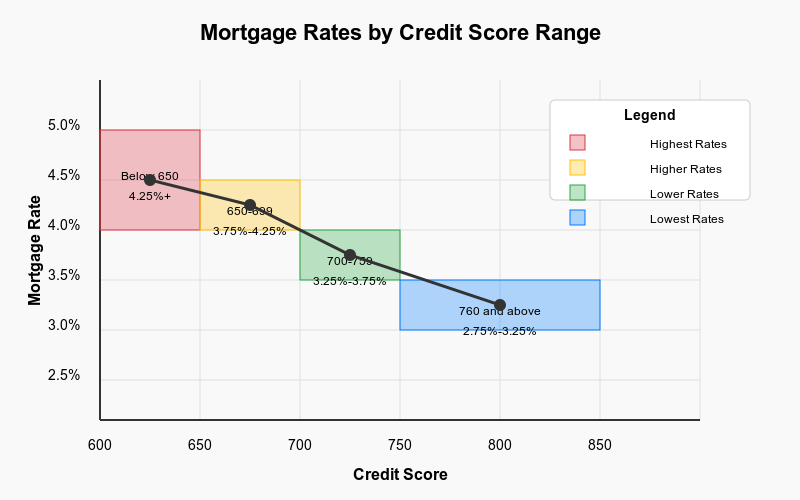

Here’s a breakdown of how your credit score can impact your interest rate:

| Credit Score Range | Estimated Mortgage Rate |

| 760 and above | 2.75% – 3.25% |

| 700 – 759 | 3.25% – 3.75% |

| 650 – 699 | 3.75% – 4.25% |

| Below 650 | 4.25% and above |

For more information, you can use this graph as a basis.

As you can see, the higher your credit score, the lower your rate will be. Also, it pays to put in the time to improve your credit score before you apply.

3. Save for a Larger Down Payment

The more money you can put down upfront, the lower your mortgage interest rate will likely be. A larger down payment is an indicator of financial stability and that you are able to handle large financial responsibilities which in turn presents a lower risk to the lender who in turn offer you a lower interest rate.

Why a Larger Down Payment Helps:

- Lower Loan-to-Value (LTV) Ratio: The larger your down payment, the lower your loan-to-value ratio will be, which signals to the lender that you are a lower-risk borrower.

- Avoid PMI: Putting down a total of 20% or more for your down payment lets you eliminate the monthly costs of PMI from your loan.

- Better Terms: As a rule of thumb, larger down payments go hand in hand with better loan terms, which may include lower interest rates and more flexible payment terms.

If your financial situation allows it, put in a larger down payment, which in turn may see you get a lower interest rate and total cost of the loan go down, also you will see that you gain equity in your home at a faster rate.

4. Shop Around for Multiple Offers

One of the easiest ways to lower your mortgage rate is by shopping around and comparing offers from several lenders. When shopping for anything do your research, compare terms and fees to get the best deal.

What to Compare:

- Interest Rates: Go to many lenders and check what they are putting out there in terms of interest rates. Even a small difference will add up to large savings over the term of the loan.

- Loan Fees and Closing Costs: Also, it goes without saying that while a very low rate is a must, at the same time look at the full package—do not forget to include the closing costs and other fees in your analysis.

- Also, note that sometimes you may see a low rate, but that is balanced out by high fees.

- Programs and Incentives: Also, what you may not know is that different lenders put out different programs, which may benefit first-time buyers or present other special incentives that could lower your rate.

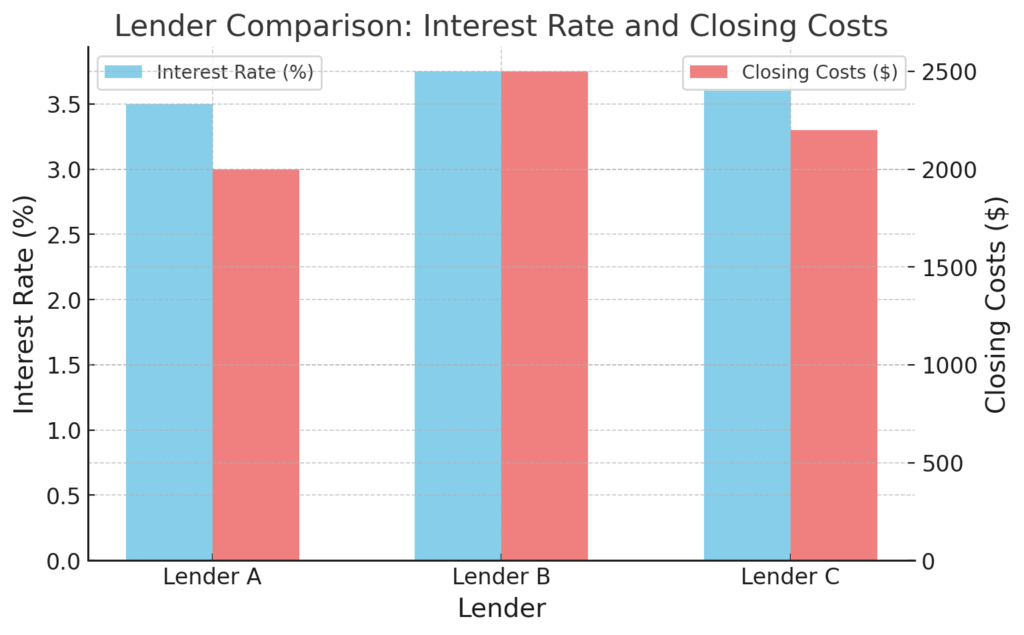

Here’s a quick checklist to help you compare:

| Lender Comparison | Lender A | Lender B | Lender C |

| Interest Rate | 3.5% | 3.75% | 3.6% |

| Closing Costs | $2,000 | $2,500 | $2,200 |

| First-Time Buyer? | Yes | No | Yes |

Here is a chart for further details.

By shopping around, you’ll get a clearer picture of the best mortgage rates available to you. Don’t go for the first option; take the time to find the best deal.

5. Consider a Shorter Loan Term

Choosing a short-term loan such as a 15-year mortgage over the more typical 30-year option may see you get lower interest rates. While your payments each month will be larger, the benefits are great.

Advantages of a 15-Year Mortgage:

- Lower Rates: 15-year loans typically come with lower rates compared to 30-year loans.

- Pay Down Your Loan Sooner: You will see your home paid off in half the time and will also see your equity grow at a much faster rate.

- Save on Interest: While your monthly payments go up, in the end you will pay off the loan for less which means you will save a great deal in interest over the life of the loan.

Short-term mortgages offer numerous advantages because they come with lower rates while requiring larger payments which result in overall financial savings for homeowners.

Frequently Asked Questions

- How do you get the best possible mortgage rate?

To secure the best mortgage rate improve your credit score, pay off present debt, and save up for a large down payment. Shop around to get many offers from various lenders, compare rates and fees. At times lock in your rate when the market is right, also if possible go for a shorter loan term which usually has a lower rate.

- How do I choose the right interest rate on my mortgage?

Which interest rates best suit you will depend on what your financial goals are and the kind of loan you have. Fixed rates provide stability and predictable payments, while variable rates may begin lower but also may go up. Look at how long you plan to live in the home and your tolerance for risk of higher rates when you are choosing your best mortgage rate.

- How do I ask for a better mortgage rate?

If at any time you think your mortgage rate may be improved, do not hesitate to ask your lender to drop it. Report to them on any progress you have made with regards to your credit score, a bigger down payment, or how the market has changed, which may play to your benefit. Also, you may negotiate with other lenders, which will in turn put pressure on your current lender to give you a better deal.

- How do I get the best loan rate?

To get the best loan rate, improve your credit score, keep your debt-to-income ratio low, and put down a large down payment. Check out different lenders to compare rates and terms. Get in to lock in a rate when the market is right, also be ready to act fast if rates drop.

- How do I choose the best interest rate?

What rate is right for you depends on your financial picture and how long-term you are with the mortgage. If you are in for the long term, a fixed-rate mortgage is the best option. For short-term plans, a variable rate with the lower introductory rate could be the way to go. Also, look into what each package includes besides the rate, which also has associated fees, to get the best deal.

Final Thoughts

The process of securing the lowest mortgage rate might seem like a challenge, but with the right strategies, it’s achievable. Focus on your credit score, put away for a larger down payment, shop around for the best deals, and lock in your rate at the right time. These actions will help you lower interest rates on your mortgage and put you in the best position for today’s market.

Timing, strategy, and informed decisions are what will get you a lower interest rate and the best mortgage rate out there. Stay proactive, and don’t settle for less. Your dream home is waiting!